Get it? Beats? I’ll be here all week.

First red day after seven straight green sessions, down about $1.60. A huge move from 511/524/(pick your measuring point). Beats acquisition confirmed, and WWDC’s just a few days away (and of course you already know about the 7-for-1 share split soon after that).

Charts might be “less instructive” than normal, and who knows what Monday’s trading will be like. So with those caveats to go along with all my other disclaimers, my “reminder” to DYODD, etc., let’s see if the charts still hold fragments of clues.

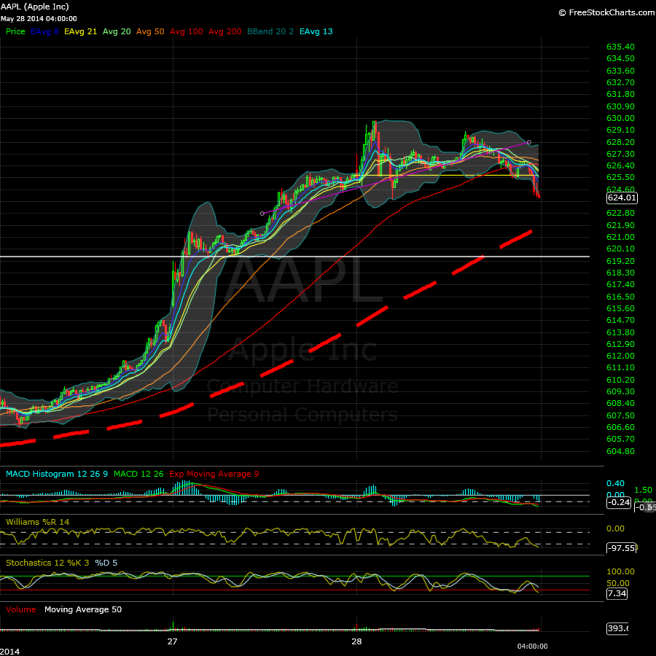

5-min chart:

– Well, maybe this is the face of an overheated micro uptrend. 😉

– Depending on how you measure measured moves, if you do – there’s just so many ways – one possible read was AAPL getting into the high 620s to around 630. Which is exactly what AAPL ended up doing from the Bollinger Band volatility compression (I guess those can be instructive even on short timeframes at least some of the time). But there were trouble signs less than one hour in…if only I were a super-savvy, ultra-dialed-in day-trader type. AAPL just couldn’t hold onto those gains end-of-day, and trailed off near the lows of the day – which is about 25 basis points lower, to keep it in perspective.

– Bull flag/descending channel read is out there, I suppose, but for now I’m looking at the micro-timeframe head and shoulders pattern with measured move of around 5 points. I said I’d point out potentially bearish reads if I saw them, and that’s one I think I see. My humble measurement from the broken neckline is a micro target of a little over 622. That’s just me, of course – you may well see things differently and for good reason.

– It’ll be interesting to see if AAPL retests the 620-622 price band, and if so, how it behaves. Actually aren’t many recent reference points until around 610ish.

– Quick little bonus 5-min chart. Bullish above the upper green line, bearish below lower line on a micro timeframe? Who knows.

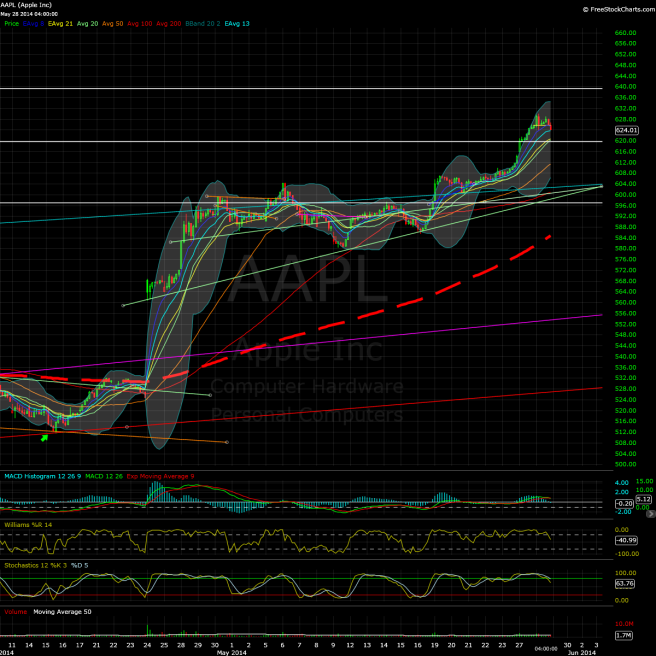

Moving on to the hourly chart:

– Not much of a red day, and not a particularly big-range trading day. Another perspective on AAPL’s last two hours of weakness, though considering AAPL’s still above the EMA-13 hourly, the instaneous read as far as Bollinger Bands are concerned is still very solid. Doesn’t look that different from the mid-May price action or Bollinger Bands up to that point.

– On the other hand, price, MACD-h (now slightly negative), and the oscillators are all headed south at the same time. Will the micro-downtrend continue tomorrow?

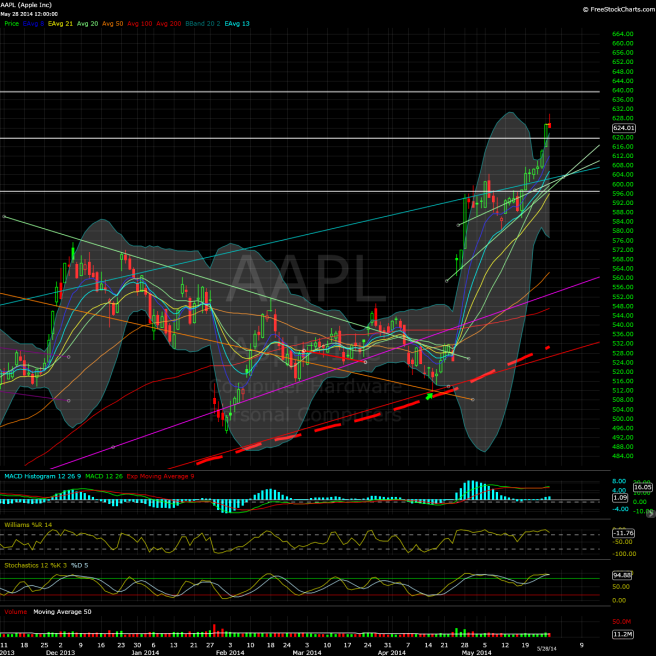

Daily chart:

– The shooting-star-ish daily candle might be the “most bearish signal” today among the few timeframes and few technical indicators I try to track. Something of a topping tail and distinctly different from the past seven sessions.

– AAPL remains outside the upper Bollinger Band, and about 12 points away from the EMA-8 per the charting software I use. Who knows if AAPL is “due” for some retrace or new consolidation, but all things considered, there certainly wouldn’t be anything “wrong” with AAPL “settling down” a little after this very quick (by recent AAPL standards) move off 511 – it’s been a lot of ground (re)covered in not a lot of time. After all, whether you consider the move to be 100 or 110-ish points, either way that’s close to two of the full measured moves from the past three uptrends, which in my humble opinion were around 60 points each. I’d imagine AAPL bulls would much prefer a controlled, constructive retrace to wild 20-25 point swings as we saw in AAPL’s last major downtrend. As a sidenote, the SMA-20, which some would expect AAPL to readily hold if still in strong uptrend, is at 599 and change and rising as of today’s close (non-div-adjusted basis).

– Several moving averages are converging around the mega-macro trendline. It’ll be interesting to see whether said macro trendline is back in play over the next days and weeks.

One red day might end up being a “false alarm” in the short term, but hey, since it’s different, couldn’t hurt to at least take notice. See you on the virtual trading floor Thursday.

Nice post! Next 5-7 trading days will be key. Look forward to your take.

Not sure if I’ll have one but should update once or twice. Thx