Courtesy of the Merriam-Webster online dictionary:

1: drooping or flagging from or as if from exhaustion : weak2: sluggish in character or disposition : listless3: lacking force or quickness of movement : slow

Which definition of the “L” forming from around June 10 or so is more appropriate? Or is it two or all three of the above?

(Click for full resolution charts)

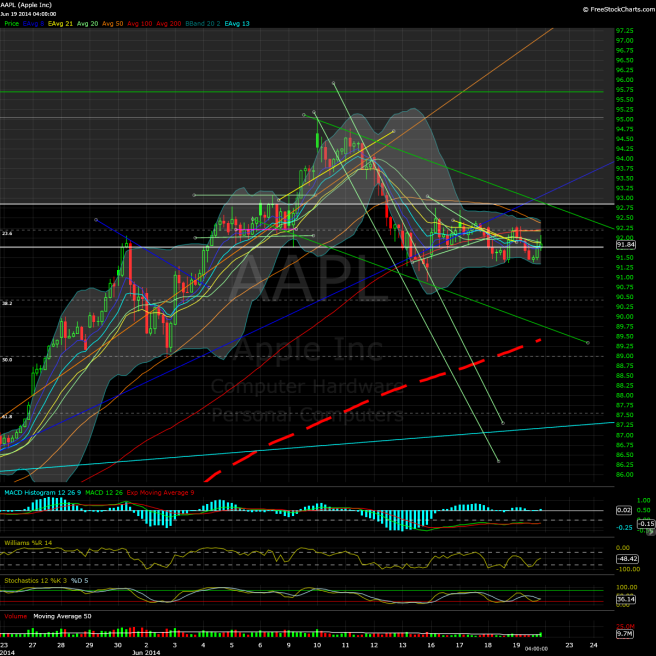

5-min chart:

– Well, no delivery on bullish promise, that’s for sure. Definite check in the bearish column.

– For whatever reason there’s slight disagreement between this charting platform and Yahoo!/Google Finance about the intraday low – “they” have it at 91.34, the chart platform at 91.37. I’ll go with Yahoo! and Google on this one – in any case, the one-penny lower low hasn’t really caused anything to happen yet.

– Is AAPL headed for breakdown at some point? If the bear flag/other bearish theories are validated, sure. AAPL didn’t hold 92, but it closed about 15 cents below. We’ll see if any visit to 91-91.30ish is a catalyst for more “decisive” price action.

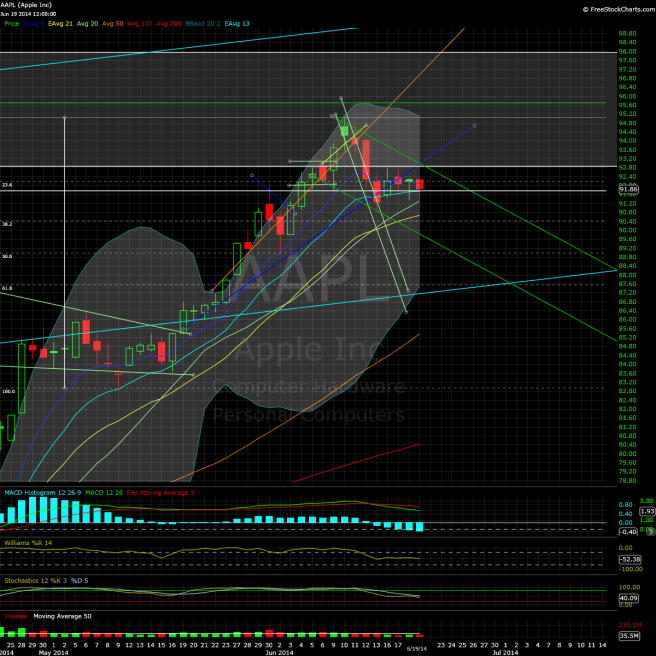

Hourly chart:

– Looks bearish/head-and-shoulderish from here, and AAPL wasn’t able to hold the SMA-20 today. But there’s been no range expansion just yet. So we’re still just waiting for the next directional move.

Wrapping up with the daily chart:

– Delaying the “inevitable” (retrace), or keeping everybody guessing? Another low-volume day, another day of not too much happening (aside from continued gradual volatility compression and AAPL approaching, but not yet breaking, the SMA-20). You’d think something will change soon, but we’ll see. I suspect volume will pick up some when market participants are more ready to “commit” on AAPL, one direction or another.

Best of luck with your Friday trading.