That’s kind of my micro-timeframe, home gamer’s “net read” for the moment, which could be wrong of course. (The chart’s been undeniably bullish from a longer-term perspective for quite some time now, and today’s trading does nothing to affect that trend.)

Not sure where we’ll go next considering the magnitude of the post-earnings rally. But the charts might be able to shed a little light on where we’re at (however less-than-useful that may be).

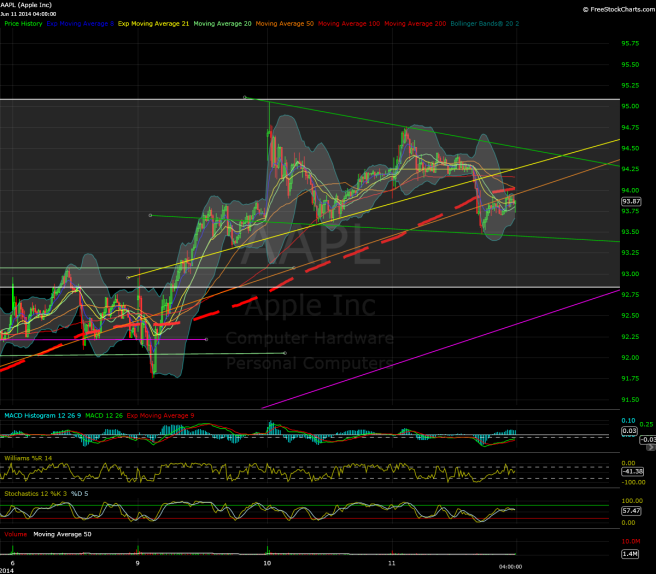

5-min chart:

– AAPL did act somewhat bearish on this very short timeframe, with that yellow trendline acting like a head-and-shoulders neckline. Whether the afternoon action is the beginning of a bounce/consolidation versus a bear flag, we may need a few sessions to see. For now, support in the mid-93s is holding, and AAPL remains comfortably over Ye Olde Resistance of 92, which has proven to be more like support so far in June.

– Bull flag trigger from June 10 didn’t hold, but there might be another directional resolution scenario on the way. At the risk of oversimplifying – bullish with a “decisive breakout” over the top descending darker green line, bearish if AAPL “decisively breaks below” the lower trendline?

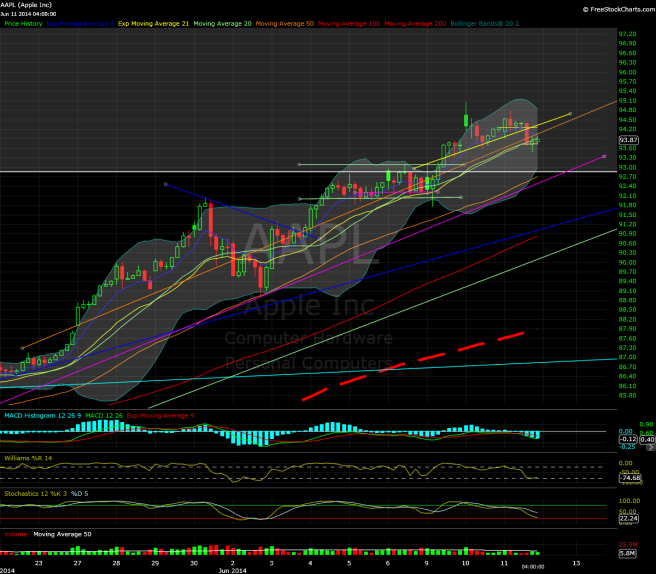

Hourly chart:

– AAPL is somewhat weak on this timeframe, though again, nothing decisive yet. While the oscillators and MACD-h are bearish, in actual price action terms, AAPL is just below mid-channel (SMA-20), with volatility compression still ongoing. I don’t think there’s been downside resolution and range expansion out of AAPL since April earnings – AAPL has tested or briefly broken below the lower Bollinger Band, but it’s “faked out” bears so far and resulted in new trend highs.

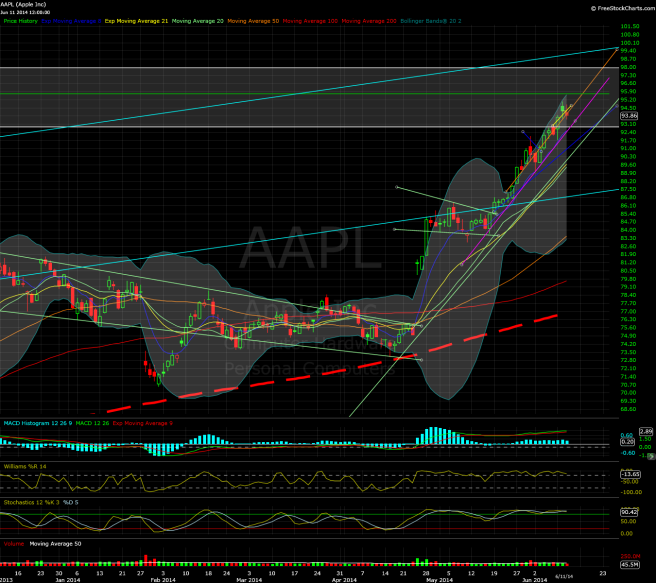

Wrapping up with the daily chart:

– AAPL continues to hum along just fine, and at a very fast clip.EMA-8 is now about 92.5 and rising, and the lower Bollinger Band continues to catch up, now at about 83.2 (mid-channel is about 89.4). It’s gonna take a lot more than one blah green day and one 40-something basis point down day to get bears’ hopes up.

I wonder if we’ll be in for a slow product news cycle for Apple for the next couple months. Notice I said product – the EU apparently would like Apple to pay more taxes, while Congress is debating holding one of those Band-Aid cash repatriation tax holidays for highways or something.

Best of luck trading on Thursday.