Warning signs are adding up this week in a pretty big way.

Could be something. Could be nothing. Could “not mean much” by late April, but to me, that’s only if AAPL finds willing buyers as a result of earnings, guidance, and/or the cash update.

Let’s see if there’s any clues in the charts.

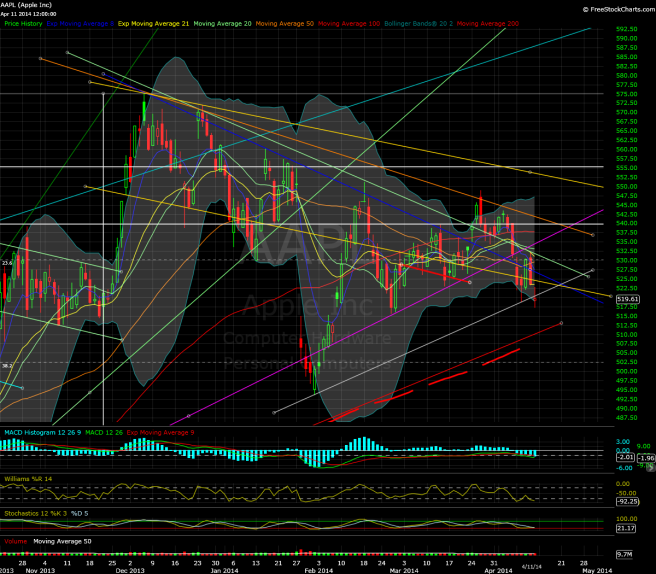

Hourly chart:

– Looks kind of like a head and shoulders pattern. Measured move – who knows? A bearish read would be around 30 points.

– AAPL hasn’t traded well since losing the purple multi-month trendline.

– Several points below blue trendline.

– Note weakening price action, change in oscillation on the Williams indicator – note squared area.

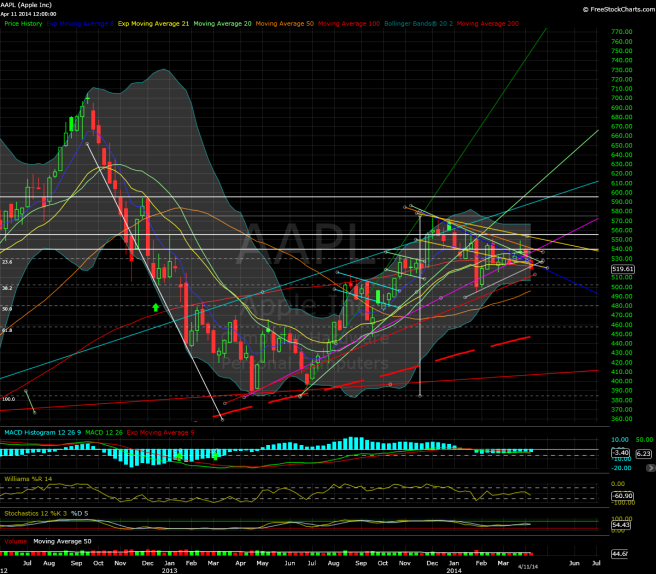

Daily chart:

– So much for the MACD-h crossover to plus territory a couple weeks ago. For now, a failure to deliver on bullish promise.

– Silver line is just there as a reference. The RED trendline under it is much more important, in my humble opinion. (Dashed red line = SMA-200)

– Inverted head and shoulders out of play currently. To restore the breakout case AAPL will need much more than a small bounce.

– AAPL has traded in the 510s in the not-too-distant past. This week will clue us in as to whether that price range is support.

– Oscillators on this timeframe looking “oversold”, but given the way AAPL and the broader markets have been trading lately, my non-expert opinion is this is no screaming buy signal by any means. Contrarians, trade with care.

Weekly chart:

– Did that inverted hammer candle two weeks ago “mean something”?

– Another head and shoulders pattern showing up on a longer timeframe? Check out July-August to the present.

– Fibonacci levels still holding – and 61.8% retrace level of the move from 490ish (call it low 510s) has not been tested yet.

– Of course, there haven’t been higher highs in a few months. The intermediate downtrend (based on MACD-h) continues.

Buckle up if you’ll be trading on Monday. Could be very, very tricky. Good luck to all.